Share

0

/5

(

0

)

It doesn't matter what field of business you are in; a satisfied customer guarantees your business's success. To maintain the satisfaction of existing customers and attract new ones, a proper system of storing and processing customer bases is necessary.

In the competitive world of forex trading, having the right CRM (Customer Relationship Management) system can make all the difference in achieving success. With many options, selecting the best Forex CRM provider for your brokerage company is crucial. Let's find out the top 10 Forex CRM provider companies in 2024 and explore key factors to consider when choosing.

Key Takeaways

Selecting the right CRM provider is vital for effectively managing customer relationships, streamlining operations, and driving business success.

Forex CRM system facilitates client management, enhances communication through various channels, enables personalisation of services, automates marketing processes, ensures compliance with regulations, and provides valuable analytical insights.

When choosing a Forex CRM provider, consider the depth of features offered, user interface intuitiveness, customisation options, integration with trading tools, and pricing structure.

Understanding the Importance of Forex CRM

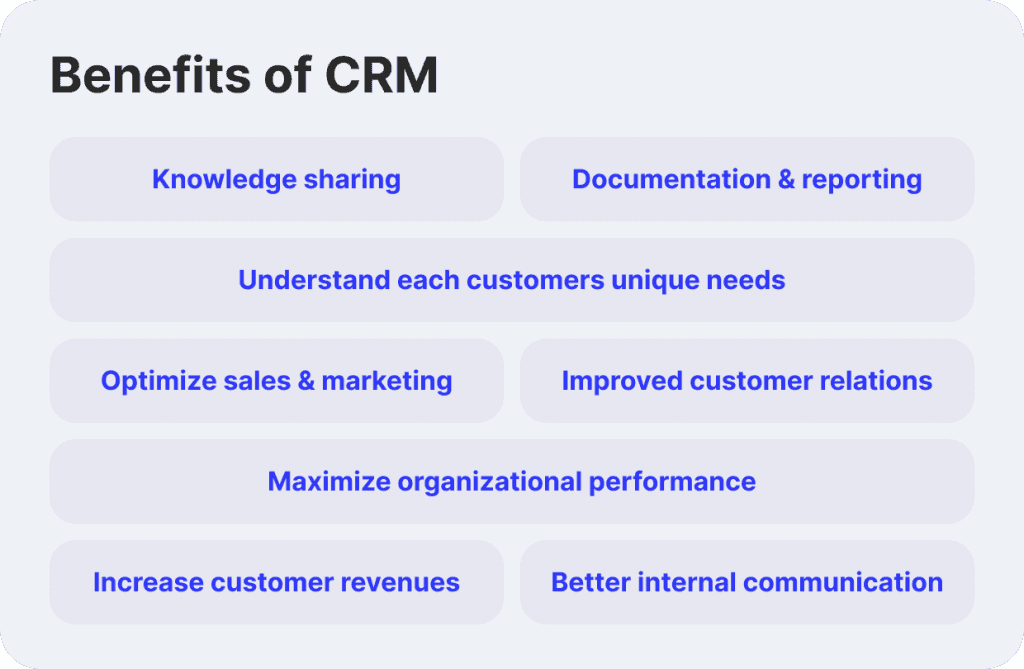

Forex CRM systems are pivotal in managing customer relationships, streamlining business operations, and boosting sales for brokerage firms. From automating marketing processes to providing advanced analytics tools, a robust CRM solution is essential for staying ahead in the competitive forex industry.

Let's outline the advantages of CRM systems in detail:

Client Management

Forex CRM allows brokers to effectively manage their client base, including registration, onboarding, and account management. It helps organise client information, communication history, and transaction details.

Enhanced Communication

CRM systems enable brokers to communicate regularly with their clients through various channels such as email, chat, and phone. This helps provide timely updates, market analysis, and support, enhancing customer satisfaction and retention.

Personalisation

By leveraging client data stored in the CRM system, brokers can personalise their services and offerings based on individual client preferences, trading behaviour, and risk appetite. This personalisation enhances clients' overall trading experience and strengthens their loyalty to the broker.

Marketing Automation

CRM platforms often include marketing automation features that enable brokers to create targeted marketing campaigns, send personalised messages, and track the effectiveness of their marketing efforts. This helps attract new clients and retain existing ones.

Compliance and Regulation

Forex CRM systems can assist brokers in maintaining compliance with regulatory requirements by capturing and storing necessary client information, documentation, and transaction records. This helps in ensuring transparency and accountability in the forex trading process.

Analytical Insights

CRM systems help brokers gain valuable insights into client behaviour, trading patterns, and market trends through advanced analytics and reporting tools. This data-driven approach helps brokers make informed decisions, optimise their operations, and identify opportunities for business growth.

[aa quote-global]

Fast Fact

In 1987, Mike Muhney and Pat Sullivan from Texas introduced the world's first contact management software for PCs, the true precursor to the modern CRM system: ACT! ACT! collected and, to a limited degree, analysed customer information, making it possible to customise communications digitally.

[/aa]

Criteria for Evaluation Top Forex CRM Providers

In assessing and selecting the best Forex CRM software, several key factors will be considered to ensure a comprehensive evaluation:

Features and Functionalities

User Interface and Ease of Use

Customisation Options

Integration with Other Trading Tools and Platforms

Customer Support and Training Services

Pricing Structure

By carefully considering these key factors, we aim to identify and evaluate the best Forex CRM platforms in 2024, offering comprehensive solutions tailored to the unique needs and challenges of forex brokerage businesses.

The Best Forex CRM Companies

Here is our choice of the best Forex CRM systems:

FYNXT

This Singaporean fintech company offers a low-code, modular Forex CRM platform known for its ease of customisation. FYNXT caters to multi-asset brokers and financial institutions, allowing them to tailor workflows across FX, CFDs, cryptocurrencies, equities, futures, and more. Their platform boasts seamless integration with popular trading platforms like MT4/MT5, making data flow smooth.

Here are some of the key things to know about FYNXT's CRM:

Designed for the financial industry: FYNXT's CRM is built with the specific needs of multi-asset brokers and FIs in mind.

Integrates with existing systems: FYNXT's CRM can integrate with your existing trading platforms and other industry-standard offerings.

Secure: FYNXT is ISO 27002 certified and GDPR-compliant, so you can be assured that your client data is secure.

Scalable: FYNXT's CRM can grow with your business. They offer a variety of plug-and-play modules that can be added as your needs change.

Overall, FYNXT's CRM is a strong option for multi-asset brokers and FIs looking for a secure, scalable CRM system designed specifically for the Forex CRM industry.

B2Broker

This one-stop place provides a comprehensive Forex CRM solution alongside other crucial services for brokers. B2Broker offers liquidity aggregation, creates white-label solutions, and facilitates payment processing for a streamlined experience. Its platform, B2Core, is a new generation of forex CRM, client cabinet, and back office software. It's definitely state-of-the-art technology for Forex and Crypto businesses.

B2Core caters to brokers, exchanges, and introducing brokers. It functions as a central hub to manage various aspects of the client relationship, including:

Client Management: B2Core allows brokers to manage customer information, accounts (including live and demo accounts), and trading activity all in one place.

Automation: B2Core automates repetitive tasks associated with client onboarding and management, freeing up staff time to focus on other areas.

Sales & Marketing: B2Core offers tools to streamline the sales process, such as reporting and analytics, to understand client behaviour and tailor marketing efforts.

IB (Introducing Broker) Management: B2Core has a dedicated module for managing IB (affiliate) partners, including commission structures and tracking their performance.

B2Core is known for its ease of use and ability to integrate with popular trading platforms, such as cTrader and MetaTrader. This integration allows for a seamless user experience for both brokers and traders. Here are some of the key benefits of B2Core for forex brokers and exchanges:

Increased Efficiency: B2Core automates tasks and centralises client data, leading to a more efficient workflow.

Improved Customer Service: B2Core allows brokers to provide better customer service by having all client information readily available.

Scalability: B2Core can grow with your business as it offers a modular design with the ability to add additional features as needed.

Overall, B2Core is a comprehensive CRM solution designed to help forex brokers and exchanges manage their client relationships more effectively.

FX Back Office

FX Back Office is a company specialising in Forex CRM software. They cater to brokers and businesses involved in foreign exchange trading. Here's a breakdown of what FX Back Office offers:

CRM for Forex: Their core product is a CRM platform built to manage client interactions within the Forex market. This includes features like lead and client follow-up, lead status allocation, and customisable access levels for sales teams.

Social Trading: They also offer functionalities related to social trading, allowing clients to copy successful traders' trades.

Mobile App: FX Back Office provides a mobile application that provides a more convenient user experience. Clients can access their accounts and potentially manage some aspects of their trading activity through the app.

Customisation: They emphasise the flexibility and customizability of their CRM solution to fit the specific needs of different-sized Forex brokerages.

Scalability: Their platform is designed to scale with a business, offering additional tools and integrations as a brokerage grows.

Automation: Automating back-office tasks is another key feature, potentially saving brokerage time and resources.

Overall, FX Back Office seems like a strong solution for Forex brokerages seeking a CRM platform that streamlines client management and offers a mobile application for on-the-go access.

CurrentDesk

CurrentDesk offers a comprehensive broker management system designed specifically for the Forex industry. They aim to help Forex brokers streamline their operations, attract more traders, and ultimately increase profits. Here's a closer look at what CurrentDesk offers:

All-in-one Platform: CurrentDesk functions as a central hub, consolidating all the necessary tools for managing a Forex brokerage under one roof. This eliminates the need for multiple disjointed software solutions.

Forex CRM Features: CurrentDesk incorporates a built-in CRM system for managing client interactions, including lead generation, client onboarding, and account management.

Back-Office Tools: They provide back-office functionalities such as trade management, reporting, and commission structures, allowing brokers to manage the operational aspects of their business efficiently.

Integrations: CurrentDesk integrates with popular trading platforms and other industry-standard tools, potentially improving workflow and data exchange.

Scalability: The platform is designed to scale with a brokerage's growth. Additional features and functionalities can be added as needed.

Overall, CurrentDesk seems like a comprehensive solution for Forex brokers seeking an all-in-one platform to manage their entire business, from client relationships and trading activities to back-office operations.

UpTrader

UpTrader is a company specialising in Forex CRM solutions and brokerage software. They cater to brokerage companies of various sizes in the Forex industry. Here's a breakdown of UpTrader's offerings:

Forex CRM: UpTrader's core product is a CRM system designed specifically for managing client interactions within the Forex market. This includes features for Lead capture and follow-up, Client onboarding and account management, Interaction tracking and communication tools, and Sales and marketing automation.

Trader's Room: UpTrader offers a Trader's Room, which is a client portal allowing traders to manage their accounts, access trading platforms, and view educational resources.

Overall, UpTrader seems like a viable option for Forex brokers seeking a CRM solution built specifically for the industry.

Tradesmarter

Tradesmarter is a leading B2B (business-to-business) technology provider specialising in white-label trading platforms for the retail foreign exchange and derivatives trading industry. It offers a CRM software solution specifically designed for the financial industry. Here's a breakdown of Tradesmarter's CRM offering:

Focus on Financial Services: Their CRM is built with the specific needs of financial agents and wealth management professionals in mind.

Client Management Features: It includes functionalities for Client data management and organisation, Communication channels (chat, email), Lead management and promotion, and Client activity tracking and reporting.

Social, Mobile, and Cloud Forex CRM Integration: Tradesmarter emphasises their CRM's use of modern technologies for better accessibility and data management.

Overall, Tradesmarter offers a CRM system alongside its white-label trading platform, catering specifically to the needs of the financial services industry.

Chetu

Chetu offers custom CRM development services, not a pre-built, off-the-shelf business Forex CRM solution. They develop CRMs for various industries, including finance. Custom Forex CRM from Chetu Includes:

Core CRM functionalities:Lead capture, contact management, deal tracking, communication tools (email, chat), reporting, and analytics.

Forex-specific features: Integration with trading platforms, client onboarding workflows, risk management tools, and performance tracking functionalities.

Customisation based on your needs: You can define the specific features and functionalities crucial for your brokerage.

M-Finance

m-Finance is a well-established provider of Forex brokerage CRM solutions specifically designed for the needs of forex brokers and Introducing Brokers (IBs). Here's a breakdown of what they offer:

The CRM includes functionalities like:

Client onboarding and account management for live and demo accounts

Multi-tier rebate management for IB commission structures

Lead capture and follow-up tools Integration with popular trading platforms like MT4 and MT5

Detailed client data analysis for profitability insights

m-Finance emphasises streamlining operations, increasing customer retention, and fostering IB growth through its CRM solutions. Their CRM is cloud-based, offering benefits like accessibility from anywhere and automatic updates. The CRM is accessible through mobile devices, allowing for on-the-go management.

m-Finance's CRM solution was recognised by MarTech Outlook as a Top CRM Solution Provider in APAC (Asia Pacific) in 2021. This award signifies industry recognition of the quality of their product.

Overall, m-Finance is a compelling choice for Forex brokers seeking a dedicated and feature-rich CRM solution.

Finalto

Finalto is a well-established player in the financial services industry, offering a range of solutions for forex brokers, including a dedicated Forex CRM. Here's a breakdown of what they offer:

Client onboarding and account management

Lead capture and development tools

Communication channels (email, chat)

Reporting and analytics on client activity and performance

Finalto emphasises CRM functionalities that can help brokers grow their business, such as client segmentation and targeted marketing campaigns. Their CRM integrates with risk management tools, providing a holistic view of client activity and potential risks.

Finalto has won awards for its CRM solution, highlighting its quality within the industry.

Leverate

Leverate is a company that offers a suite of solutions specifically designed for the Forex brokerage industry. While they don't provide a standalone CRM system, they offer a CRM component within their broader platform geared towards Forex brokers. Here's a breakdown of Leverate's offerings:

LXCRM (Leverate CRM): This CRM component is built into Leverate's platform. It focuses on managing client interactions and relationships within the Forex market.

Features of LXCRM include:

Lead capture and follow-up tools

Client onboarding and account management functionalities

Interaction tracking and communication channels (email, chat)

Reporting and analytics on client activity and performance

LXCRM is designed to integrate seamlessly with other components of the Leverate platform, such as the trading platform and back-office tools. Leverate emphasises LXCRM's role in client retention through features like automated communication and activity tracking.

Key Features to Look for in a Forex CRM Provider

If you decide to make your own trial and determine the best Forex CRM products, try not to miss these steps:

To streamline trading operations, ensure compatibility with popular trading platforms like MetaTrader 4/5 and cTrader.

Look for CRM systems with insightful analytics for tracking trading activity, customer interactions, and business performance.

In today's mobile-centric world, having a mobile-compatible CRM solution is essential for traders on the go. So check this option.

Rank higher in your list of CRM providers that prioritise data security measures to protect sensitive customer information and comply with regulatory requirements.

Consider the pricing structure and customisation options offered by each CRM provider. While affordability is important, choosing a CRM solution tailored to meet your business needs and requirements is equally crucial.

Evaluate the level of customer support each CRM provider provides, including response times, technical assistance, and user satisfaction ratings. A responsive and knowledgeable support team can significantly impact your overall experience with the CRM system.

Conclusion

Choosing the best Forex CRM provider is a decision that shouldn't be taken lightly. You can select a CRM solution that aligns with your business goals and objectives by carefully considering features, pricing, customisation options, and customer support. With the right CRM partner by your side, you can streamline operations, enhance customer relationships, and drive success in the dynamic world of forex trading.

Remember, the key to success lies in choosing a Forex CRM provider that meets your current needs and has the flexibility and scalability to grow with your business in the years to come.

FAQ

What is the best Forex CRM tool?

Forex CRM is a powerful tool for forex brokers to manage their interactions with clients and streamline their business operations.

What is CRM in forex trading?

For Forex brokers, a customer relationship management system is the fundamental operating system that enables the smooth running of your business daily.

What does a CRM tool do?

CRM tools support marketing, sales, customer service functions and business processes.

Read also